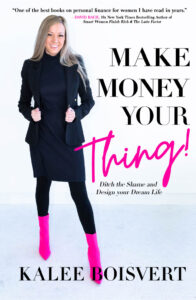

Writer Kalee Boisvert chats with me today about her new non-fiction book about personal finances, Make Money Your Thing.

Bio:

Kalee Boisvert has been in the financial industry for over 15 years, but her love of money started very young. Growing up in a single parent household, she watched her mom struggle with finances and wished there was something she could do to help. She also realized that she needed to find her own way to save and earn if she wasn’t going to allow her circumstances to define her. And so, her own journey into financial literacy and wealth management began.

Kalee chose to become a financial advisor to empower and support people to put an end to their money-related stress.

To further her efforts supporting financial literacy, Kalee has two books being released in 2023 – a children’s picture book called MoneyWise Mabel’s Bursting Bank, and a non-fiction book called Make Money Your Thing! Which aims to build confidence and empower people in their financial lives.

Welcome, Kalee. Please tell us about your current release.

Make Money Your Thing is a book to support women to feel more comfortable and confident about their finances.

What inspired you to write this book?

I wrote Make Money Your Thing to empower women in building confidence around finances. As a single mom and financially independent woman, my early fascination with money stemmed from growing up with limited resources. Viewing it as a math problem, I delved into learning everything I could to “solve” it. Entering the finance industry, I was eager to share my knowledge, especially with women. Initially, I noticed a lack of enthusiasm, so I created a safe space through women-only lunch and learns. When the pandemic halted those sessions, I conceived the idea of this book to continue sharing financial wisdom with women in an engaging and accessible format.

Excerpt from Make Money Your Thing:

When money is your “thing” you can feel completely at ease about it and confident that you’re well on your way to achieving your biggest money dreams. I know this because I made money my thing, and now I get to witness other women do it as well through my work.

If you haven’t felt confident about your money up until this point, that’s completely understandable. Money is part of your daily life, but there’s a good chance you’ve had zero opportunities in terms of financial literacy. And for that, you can blame your parents (kidding. . . sort of ). I’m going to bet that money lessons weren’t the focus of dinner conversations in your household. But in your parents’ defense, they were probably doing the best they could. They probably weren’t taught much about money growing up either.

But surely you’ve built your financial smarts in school, along with algebra, history, and geography? Again, not likely. Unfortunately, financial literacy still has not been widely adopted in formal education systems in North America. If you didn’t have official learning opportunities along the way, it makes sense that you don’t feel confident and empowered on the topic of money. Apparently, knowing how to play the recorder, recite the periodic table of elements, and do long division by hand matters more than learning how to earn, save, and invest your money. Sounds ridiculous when you put it that way, doesn’t it?

Most adults know nothing about money. And if you think that reaching out to financial experts holds the key to this problem, you may be sadly mistaken. You’ll probably find that many major financial institutions are slow to accommodate and welcome women into wealth conversations.

What exciting project are you working on next?

I am now working on a book about money that will be aimed at teens and young adults. This might be one of the most pivotal times in one’s life to establish great money habits to set the stage for financial success. And, unfortunately, young people often don’t learn about these concepts in school.

When did you first consider yourself a writer?

It’s an excellent question because I hesitated to embrace the title of “writer.” Imposter syndrome posed a challenge when I started, making me reluctant to identify as a writer. However, with two closely released books—the other one being a kids’ picture book—I started feeling more at ease acknowledging myself as a writer once they were officially published.

Do you write full-time?

I don’t write full-time; my primary role is in my financial advisory business, and as a single mom, finding time for writing can be challenging. I prefer dedicating an hour in the morning to write. When engrossed in a writing project, I schedule writing time into my calendar, treating it as non-negotiable, ensuring I show up without specific expectations—approaching it like any other job.

What would you say is your interesting writing quirk?

Writing at my desk isn’t my style. I hold the belief that creativity eludes me there, reserved for work and number crunching. Consequently, I choose various spots around my home to write. A favorite is perched on my bed, laptop on a pillow, even though this is probably terrible for my back.

As a child, what did you want to be when you grew up?

My mom once asked me what I wanted to do at the age of four, and my response was, “I want to collect money.” It seems I foresaw a future entwined with money even at that young age!

Anything additional you want to share with the readers?

It’s crucial for everyone to understand that financial circumstances don’t define who you are or what you can achieve. I firmly believe in the limitless potential of individuals, having pursued ambitious goals despite growing up in poverty, such as writing a book about money. Don’t let circumstances limit your aspirations; chase your wildest dreams relentlessly, ignoring doubts from others. If you envision it and believe it, you can undoubtedly achieve it.

Links:

Website | Instagram | Twitter | LinkedIn | Facebook | Amazon